Starting an import business from China to India might seem overwhelming at first glance. However, thousands of Indian entrepreneurs have successfully built profitable ventures by sourcing products from Chinese manufacturers. The key lies in understanding the complete China import procedure and following a systematic approach.

China remains India’s largest trading partner, with bilateral trade exceeding $130 billion annually. This trade relationship offers tremendous opportunities for Indian importers seeking cost-effective products across various categories. Whether you’re planning to import electronics, machinery, textiles, or consumer goods, this comprehensive guide will walk you through every essential step.

The beauty of sourcing from China today is that the process has become more streamlined compared to a decade ago. Digital platforms, improved logistics networks, and established trade protocols have made cross-border commerce accessible even for first-time importers. Nevertheless, success requires proper knowledge of documentation, regulations, and best practices.

Understanding the Basics of Sourcing from China

Before diving into the technicalities, it’s important to grasp why China continues to dominate global manufacturing. The country has built an unparalleled industrial ecosystem over several decades. From raw materials to finished products, Chinese suppliers can handle orders of virtually any size with impressive turnaround times.

For Indian importers, this translates to competitive pricing and product variety that’s hard to match elsewhere. Chinese manufacturers have mastered economies of scale, allowing them to produce quality goods at lower costs. Moreover, the geographic proximity between China and India means shorter shipping times compared to sourcing from Western countries.

However, successful sourcing from China requires more than just finding cheap products online. You need to verify supplier credibility, ensure product quality meets Indian standards, and navigate the legal requirements on both sides. Many first-time importers make costly mistakes by rushing into deals without proper due diligence.

Step-by-Step China Import Procedure

Research and Identify Your Product Niche

Starting with thorough market research forms the foundation of a profitable import business. Rather than importing products randomly, focus on items with consistent demand in India. Analyze market trends, competition levels, and profit margins before committing your capital.

Consider products where Chinese manufacturing expertise provides genuine value. Electronics, machinery parts, industrial equipment, home appliances, and certain raw materials typically offer better margins. Additionally, investigate whether your chosen product category requires special certifications or licenses in India.

Visit online marketplaces like Alibaba, Made-in-China, and Global Sources to explore product options. These platforms feature thousands of verified suppliers, making initial research considerably easier. Pay attention to minimum order quantities (MOQ), pricing structures, and customization possibilities during this phase.

Finding and Vetting Chinese Suppliers

Selecting the right supplier represents perhaps the most critical decision in your sourcing journey. A reliable manufacturer can become a long-term business partner, while a problematic one can lead to quality issues, delayed shipments, and financial losses. Therefore, invest adequate time in supplier evaluation.

Start by creating a shortlist of potential suppliers based on their product range, experience, and certifications. Look for manufacturers with export experience, particularly those familiar with the Indian market. Check if they hold relevant quality certifications such as ISO, CE, or industry-specific standards.

Communicate directly with shortlisted suppliers through email or messaging platforms. Ask detailed questions about their production capacity, quality control processes, and past experience with Indian clients. Request product samples before placing bulk orders—this step cannot be overemphasized, as it reveals actual product quality.

Furthermore, consider conducting factory audits if you’re planning substantial orders. Third-party inspection companies can verify factory credentials, production capabilities, and working conditions on your behalf. While this adds upfront costs, it significantly reduces long-term risks associated with unreliable suppliers.

Negotiating Prices and Terms

Once you’ve identified promising suppliers, negotiation skills become crucial. Chinese manufacturers expect buyers to negotiate, so don’t hesitate to discuss pricing, payment terms, and delivery schedules. However, approach negotiations professionally and reasonably—building mutual trust matters more than squeezing every last rupee.

Understand that the quoted price often includes room for negotiation, especially for larger orders. Suppliers typically offer better rates when you commit to higher volumes or establish long-term purchasing relationships. Additionally, inquire about various payment options such as Letter of Credit (LC), Telegraphic Transfer (TT), or trade assurance programs.

Clarify all terms regarding product specifications, packaging requirements, and quality standards in writing. Misunderstandings about these aspects cause numerous disputes between buyers and sellers. Create detailed purchase orders specifying product codes, quantities, unit prices, delivery terms, and quality benchmarks.

Payment terms deserve special attention during negotiations. While suppliers prefer full advance payment, this carries significant risk for importers. Instead, negotiate for payment structures like 30% advance and 70% upon shipment, or use platforms offering buyer protection. Secure payment methods protect both parties and facilitate smoother transactions.

Essential Documentation for Importing from China to India

Obtaining Import Export Code (IEC)

Before you can legally import goods into India, you must obtain an Import Export Code from the Directorate General of Foreign Trade (DGFT). This unique 10-digit code is mandatory for all import-export transactions and remains valid for a lifetime once issued. The application process has become largely digitized, making it relatively straightforward.

Apply for your IEC through the DGFT online portal by submitting your PAN card, Aadhaar card, passport-sized photographs, and bank certificate. The application fee is nominal, and approval typically comes within a few days if all documents are in order. Additionally, ensure your business is registered—whether as a proprietorship, partnership, or company—before applying.

Keep in mind that the IEC is just one piece of the documentation puzzle. Depending on your product category, you might need additional licenses or permits. Certain goods like pharmaceuticals, food items, chemicals, and electronics require specific import authorizations. Check the Indian Trade Portal or consult with a customs broker to understand product-specific requirements.

Preparing Export-Import Documents

Proper documentation forms the backbone of smooth customs clearance. Both Chinese and Indian customs authorities require specific documents to process international shipments. Missing or incorrect paperwork can result in delays, penalties, or even seizure of goods. Therefore, maintaining complete and accurate documentation is non-negotiable.

On the Chinese side, your supplier should provide a commercial invoice, packing list, and certificate of origin. The commercial invoice details the transaction value, product descriptions, and terms of sale. Meanwhile, the packing list specifies how goods are packed, including dimensions and weights of each package. The certificate of origin proves where products were manufactured, which affects duty calculations.

For Indian customs, you’ll need to present the Bill of Entry, which declares the goods being imported. Additionally, prepare the Bill of Lading (for sea freight) or Airway Bill (for air freight), which serves as the shipment receipt and contract between shipper and carrier. Insurance documents and the import license (if applicable) complete the standard documentation package.

Moreover, some products require quality certificates or compliance documents. Electronics need BIS certification, food items require FSSAI approval, and toys must meet safety standards. Research these requirements well in advance, as obtaining certifications can take weeks or months. Working with experienced customs brokers simplifies this process significantly.

Understanding Customs Duty and Import Taxes

Calculating Total Landed Cost

Many new importers focus solely on the product cost while overlooking additional expenses that substantially increase the final landed cost. Understanding the complete cost structure helps you price products correctly and maintain healthy profit margins. The landed cost includes the product price, shipping charges, insurance, customs duty, and various taxes.

Start with the FOB (Free on Board) price, which is what you pay the supplier. Then add international shipping costs—either sea freight or air freight depending on your urgency and budget. Sea freight is economical for large volumes but takes longer, while air freight works better for smaller, time-sensitive shipments.

Next, factor in customs duty, which varies based on product category and value. India uses the Harmonized System of Nomenclature (HSN) to classify goods and determine applicable duty rates. Basic customs duty can range from 0% to 100%, though most products fall within the 10-30% range. Check the Indian Customs website or consult with a customs broker to find the exact rate for your product.

Additionally, add the Goods and Services Tax (GST), which applies to most imports. The integrated GST (IGST) rate varies from 5% to 28% depending on the product category. Social Welfare Surcharge (SWS) at 10% of the customs duty and potential anti-dumping duties on specific products should also be considered. Insurance costs, typically 1-2% of shipment value, round out the major cost components.

Payment of Import Duties

Once your shipment arrives at an Indian port, you must clear customs before taking possession. The customs clearance process involves filing the Bill of Entry, paying applicable duties and taxes, and obtaining clearance from customs officials. This procedure typically takes 1-3 days for standard shipments, though complex cases may require longer.

Work with a licensed customs broker who can navigate the clearance process efficiently. These professionals understand local procedures, maintain relationships with customs officials, and can expedite paperwork. While you can handle customs clearance yourself, the complexity and time involved make professional assistance worthwhile, especially for first-time importers.

Payment of duties and taxes now happens electronically through the Indian Customs Electronic Gateway (ICEGATE). You’ll need to create an account on ICEGATE and link it with your IEC. Once the Bill of Entry is assessed and duty amount determined, pay through internet banking or other approved payment methods. The system generates a payment confirmation, which you’ll need for cargo release.

Shipping and Logistics Management

Choosing Between Sea and Air Freight

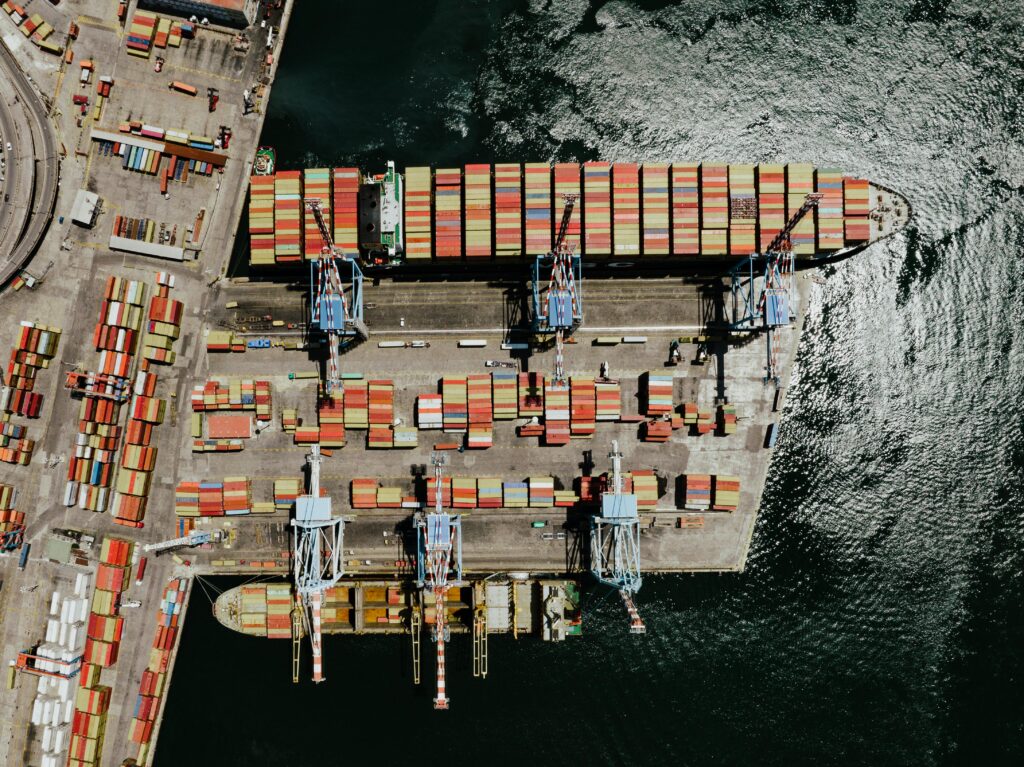

Selecting the appropriate shipping method significantly impacts both your costs and delivery timelines. Sea freight remains the preferred choice for most importers due to its cost-effectiveness, particularly for heavy or bulky items. Container shipping offers two main options: Full Container Load (FCL) and Less than Container Load (LCL).

FCL makes sense when you have enough cargo to fill an entire container, typically 20-foot or 40-foot containers. This option provides better security since your goods aren’t mixed with other shipments. Moreover, FCL usually means faster transit and lower per-unit shipping costs for large volumes. However, smaller importers often opt for LCL, where multiple shippers share container space and costs.

Air freight, despite higher costs, offers distinct advantages for certain situations. Time-sensitive products, high-value lightweight items, or small trial orders often justify air shipping expenses. The transit time difference is dramatic—air freight takes 5-7 days while sea freight requires 15-30 days from most Chinese ports to major Indian destinations.

Furthermore, consider factors like product fragility, expiration dates, and market demand volatility when deciding. Electronics and fashion items benefit from faster air delivery, while non-perishable bulk goods travel well by sea. Calculate the total cost including inventory holding expenses and potential lost sales to make informed decisions.

Working with Freight Forwarders

Freight forwarders serve as crucial intermediaries who manage the complex logistics of international shipping. These professionals coordinate with carriers, handle documentation, arrange insurance, and track shipments throughout the journey. For most importers, especially those new to international trade, partnering with experienced freight forwarders proves invaluable.

Choose a freight forwarder with proven experience in China-India trade routes. They should have established relationships with reliable carriers and agents at both ends. Request quotes from multiple forwarders, comparing not just prices but also service levels, transit times, and past customer reviews.

Your freight forwarder will arrange pickup from the Chinese supplier’s location and handle export formalities in China. They’ll book cargo space with shipping lines or airlines, prepare required documents, and coordinate with the destination port or airport in India. Additionally, they can arrange for cargo insurance, protecting your shipment against loss or damage during transit.

Maintain regular communication with your forwarder throughout the shipping process. Track your shipment using the provided container or airway bill number. Immediately address any issues that arise, such as documentation discrepancies or delays. Remember that forwarders work for you—don’t hesitate to ask questions or request updates whenever needed.

Quality Control and Product Inspection

Pre-Shipment Inspection Process

Quality control separates successful importers from those who struggle with returns and customer complaints. Never assume that products will match sample quality or meet specifications without verification. Implementing a robust inspection process safeguards your investment and business reputation.

Pre-shipment inspection (PSI) should occur when production is 80-100% complete and products are ready for packaging. This timing allows you to identify issues before shipment while still leaving room for corrections if problems arise. You can either travel to China for personal inspection or hire third-party inspection companies—the latter being more practical and cost-effective for most importers.

Professional inspection services like SGS, Bureau Veritas, or AsiaInspection offer comprehensive quality checks at reasonable rates. Inspectors verify that products match your specifications, check for defects, ensure proper functioning, and confirm that packaging meets requirements. They provide detailed reports with photographs, helping you make informed decisions about shipment acceptance.

During inspection, focus on critical quality parameters specific to your product category. Check dimensions, materials, colors, functionality, and packaging quality. Verify that products carry required certifications and markings. Request testing of random samples to ensure consistency across the batch. While inspection adds to your costs, it’s far cheaper than dealing with defective inventory.

Handling Quality Issues

Despite best efforts, quality issues occasionally arise. How you handle these situations determines whether a problem becomes a minor setback or a major disaster. Establish clear quality standards and defect tolerance levels in your purchase contract before production begins. This documentation protects your interests if disputes occur.

If inspection reveals problems, communicate immediately with your supplier. Provide specific details about defects, including photographs and measurements. Most reputable manufacturers will offer to fix issues, remake products, or provide partial refunds depending on the severity. However, timing matters—addressing problems before shipment is infinitely easier than dealing with defective goods in India.

For minor defects affecting only a small percentage of products, negotiate a price reduction or replacement of defective units in the next order. Major quality failures require more drastic action, potentially including order cancellation and refund demands. This is where using secure payment methods and maintaining proper documentation becomes critical.

Prevention remains better than cure in quality management. Build relationships with suppliers who consistently deliver quality products. Consider placing smaller trial orders with new suppliers before committing to large volumes. Gradual scaling reduces risks while allowing you to evaluate supplier reliability firsthand.

Common Challenges and How to Overcome Them

Language and Communication Barriers

Language differences pose significant challenges when sourcing from China, though the situation has improved considerably over recent years. Many Chinese suppliers now employ English-speaking sales representatives, particularly those regularly dealing with international clients. Nevertheless, misunderstandings still occur due to language nuances and cultural differences.

Use clear, simple English when communicating with suppliers. Avoid idioms, slang, or complex sentence structures that might confuse non-native speakers. When discussing technical specifications, supplement verbal descriptions with drawings, photos, or samples. Visual communication transcends language barriers and reduces misinterpretation risks.

For critical negotiations or complex technical discussions, consider hiring a translator or interpreter. This investment pays dividends by ensuring both parties fully understand terms, specifications, and expectations. Additionally, written communication provides documentation you can reference later if disputes arise.

Patience and cultural sensitivity go a long way in building strong supplier relationships. Understand that Chinese business culture differs from Indian practices in various aspects. They value relationship-building and may prefer indirect communication styles. Adapt your approach while maintaining professional standards and clear expectations.

Payment Security Concerns

Payment security understandably concerns importers, especially when dealing with unfamiliar suppliers in a foreign country. While risk exists in international trade, several mechanisms can protect your interests. The key lies in choosing appropriate payment methods and following safe transaction practices.

Letter of Credit (LC) offers maximum security for substantial orders. This bank-backed payment instrument ensures that suppliers receive payment only after meeting specified conditions, typically including shipment proof and document submission. Though LCs involve banking fees and require longer processing times, they protect both buyers and sellers effectively.

For smaller orders, consider using trade assurance programs offered by platforms like Alibaba. These programs hold your payment in escrow, releasing funds to suppliers only after you confirm satisfactory receipt of goods. While protection limits exist, trade assurance provides reasonable security for moderate-value transactions.

Advance payment poses the highest risk, yet suppliers often request it for first-time buyers. If you must pay in advance, start with smaller trial orders to test supplier reliability before committing larger amounts. Research suppliers thoroughly, checking business licenses, factory authenticity, and customer reviews. Video calls showing production facilities can also help verify legitimacy.

Building trust gradually works better than rushing into large transactions. Successful long-term relationships with Chinese suppliers often begin with small orders and cautious steps. As suppliers demonstrate reliability and quality consistency, you can confidently increase order sizes and adjust payment terms mutually.

Legal and Regulatory Compliance

Import Restrictions and Prohibited Items

India maintains specific regulations regarding what can and cannot be imported. Understanding these restrictions prevents legal troubles and financial losses. The Indian government periodically updates the ITC (HS) classification of export-import items, specifying free, restricted, and prohibited categories for different products.

Prohibited items cannot be imported under any circumstances and include things like tallow fat, beef products, wild animals, and narcotic substances. Restricted items require special licenses or permissions before import. These categories include certain chemicals, drugs, seeds, live plants, and telecommunication equipment. Check the DGFT website for the current list of restricted and prohibited goods.

Some products face anti-dumping duties designed to protect domestic industries from unfairly priced imports. Countries like China, in particular, face such duties on numerous product categories including steel, chemicals, and industrial goods. Before finalizing your product selection, verify whether any special duties apply to avoid unexpected cost increases.

Additionally, products must comply with Indian standards and safety regulations. The Bureau of Indian Standards (BIS) mandates certification for various products including electronics, steel items, and consumer goods. Without proper certification, customs will not release your shipment. Factor in the time and cost of obtaining necessary certifications during your planning phase.

Intellectual Property Considerations

Intellectual property (IP) protection deserves serious attention when importing from China. While the country has improved IP enforcement significantly, issues still arise. If you’re importing branded products, ensure you have proper authorization and genuine items rather than counterfeits. Importing counterfeit goods can result in legal action, fines, and damaged reputation.

For private label products or custom designs, protect your intellectual property proactively. Register your trademarks and designs in India before sharing them with Chinese manufacturers. Consider registering in China as well if planning substantial production volumes there. Non-disclosure agreements (NDAs) provide additional protection, though enforcement can be challenging.

When developing custom products, be cautious about sharing proprietary information. Some unscrupulous manufacturers might use your designs for other clients or create knockoffs. Start with smaller batches until trust is established. Work with suppliers who respect IP rights and have good reputations in this regard.

Building Long-Term Supplier Relationships

Maintaining Regular Communication

Successful import businesses thrive on strong supplier relationships rather than transactional interactions. Once you find reliable manufacturers, invest in nurturing these partnerships. Regular communication, even when you’re not placing orders, keeps your business top-of-mind and often leads to better pricing, priority treatment, and improved service.

Share your business plans and growth projections with key suppliers. When they understand your trajectory, they can plan production capacity, offer bulk discounts, and suggest improvements. This collaborative approach benefits both parties—suppliers gain reliable customers while you secure stable supply sources.

Visit your main suppliers periodically if possible. Face-to-face meetings build trust faster than emails or calls. Factory visits let you see production processes, meet key personnel, and identify potential improvements. These visits also demonstrate your commitment to the relationship, which suppliers appreciate and often reciprocate with better service.

Provide feedback consistently, both positive and negative. When suppliers meet or exceed expectations, acknowledge their efforts. When issues occur, communicate clearly but constructively. Good suppliers value feedback that helps them improve and retain important customers like you.

Negotiating Better Terms Over Time

As your relationship with suppliers matures and order volumes increase, don’t hesitate to renegotiate terms. Loyal customers deserve better pricing, payment terms, and service levels. However, approach renegotiations professionally, emphasizing mutual benefits rather than one-sided demands.

Present data showing your order history, growth trends, and future projections. Suppliers are more likely to offer better terms when they see potential for sustained business. Rather than focusing solely on price reductions, consider negotiating improvements in other areas like payment terms, quality standards, or delivery schedules.

Explore exclusive arrangements or product development partnerships with your best suppliers. When you commit to consistent volumes, they might invest in customizations or dedicate production lines to your orders. Such arrangements can provide competitive advantages through unique products or favorable terms.

Conclusion

Importing from China to India offers tremendous business opportunities when approached systematically. Understanding the complete China import procedure, from supplier selection through customs clearance, sets you up for success. While challenges exist, thousands of Indian entrepreneurs have built profitable ventures through careful planning and execution.

Start small, learn continuously, and scale gradually as you gain experience and confidence. Focus on building genuine relationships with reliable suppliers rather than chasing the lowest prices. Invest in proper documentation, quality control, and legal compliance—these fundamentals prevent costly mistakes that can derail your business.

The China-India trade corridor will continue growing in the coming years, creating opportunities across various product categories. Whether you’re a first-time importer or looking to expand existing operations, following the guidelines in this comprehensive guide will help you navigate the sourcing journey successfully. Take that first step, remain persistent through initial challenges, and watch your import business flourish.

Remember that expertise in sourcing from China develops over time through experience and learning. Don’t let fear of the unknown prevent you from starting. With proper preparation, due diligence, and commitment to learning, you can join the ranks of successful Indian importers who have transformed Chinese manufacturing strengths into profitable businesses serving Indian markets.