Importing products from India to the UAE represents one of the most profitable trade opportunities in 2026, yet many international buyers find themselves overwhelmed by documentation requirements, customs procedures, and compliance regulations. Between navigating federal customs policies, understanding duty structures, and ensuring proper licensing, the process can quickly become complex. Additionally, businesses often worry about hidden costs, clearance delays, and whether their products meet UAE regulatory standards. The consequences of getting it wrong include costly shipment holds, unexpected fees, and potential legal complications that damage your bottom line.

Understanding exactly what’s required before you begin makes the difference between smooth operations and expensive mistakes. India and the UAE maintain one of the strongest bilateral trade relationships globally, with the India-UAE Comprehensive Economic Partnership Agreement transforming how businesses access both markets. This guide provides the complete roadmap you need—from licensing requirements and documentation to customs clearance and CEPA benefits—ensuring your first shipment arrives on time, within budget, and fully compliant with UAE regulations.

Quick Answer: UAE Import Requirements from India

Importing to UAE from India requires a valid UAE trade license, customs registration code, and proper documentation including commercial invoices, certificates of origin, and bills of lading. The standard customs duty is 5% of CIF value plus 5% VAT, though 80% of Indian exports qualify for zero duty under the India-UAE CEPA agreement. Businesses must register with UAE Customs, classify goods correctly using HS codes, and ensure products meet Emirates Authority for Standardisation requirements before shipment clearance.

Understanding UAE Import Regulations and Compliance Framework

The UAE operates under a federal customs structure coordinated by the Federal Authority for Identity, Citizenship, Customs and Ports Security (ICP), formerly the Federal Customs Authority. However, each of the seven emirates maintains its own customs authorities with offices at airports, seaports, and land border entry points. This dual-level system means importers must understand both federal regulations and emirate-specific requirements.

Federal and Emirate-Level Customs Authorities

Dubai Customs, Abu Dhabi Customs, Sharjah Customs, and other emirate-level authorities handle day-to-day clearance operations while adhering to federal guidelines set by ICP. The Federal Customs Authority establishes unified customs policies, tariff schedules, and compliance standards applicable across all emirates. This structure ensures consistency in duty rates and documentation requirements regardless of which emirate serves as your entry point.

The UAE’s membership in the Gulf Cooperation Council means customs policies align with the GCC Common Customs Tariff framework. Consequently, businesses importing to the UAE benefit from standardized procedures recognized throughout the GCC region, facilitating potential expansion into other Gulf markets once you establish UAE operations.

World Trade Organization Compliance Requirements

As a World Trade Organization member, the UAE follows WTO import regulations including non-discrimination principles, transparent customs procedures, and standardized valuation methods. This membership provides predictability for international businesses and ensures UAE customs practices meet global standards. Furthermore, WTO membership means the UAE regularly updates trade policies to reflect international best practices, creating a business-friendly import environment.

The WTO framework also governs how the UAE implements anti-dumping measures, safeguards, and import licensing procedures. Therefore, understanding your rights and obligations under WTO rules helps navigate situations where additional scrutiny or requirements apply to specific product categories.

Essential Licensing and Registration Requirements

Before importing any goods into the UAE, businesses must complete mandatory registration and licensing procedures. These requirements apply whether you’re establishing a mainland company, setting up in a free zone, or working through a local agent.

UAE Trade License Requirements by Business Type

Every importer needs a valid trade license issued by the Department of Economic Development in the respective emirate where you establish operations. The license type depends on your business structure and product categories. A General Trading License authorizes import, export, and re-export activities across multiple product categories, making it ideal for businesses handling diverse product lines.

Alternatively, specialized trading licenses limit activities to specific product categories but often involve simpler application processes and lower fees. For businesses focused exclusively on importing particular goods like textiles, electronics, or food products, a specialized license provides adequate authorization at reduced cost.

Free zone companies receive trade licenses from the respective free zone authority rather than DED. Notably, free zone licenses historically restricted mainland UAE trading, though recent regulatory changes increasingly allow free zone companies to conduct mainland business with proper approvals. This flexibility makes free zones attractive for international businesses establishing UAE operations.

Customs Registration and Code Acquisition

After securing your trade license, you must register with UAE Customs and obtain a customs code—a unique identification number used for all customs transactions. This registration process typically takes three working days when completed through the Dubai Trade Portal or equivalent systems in other emirates.

Your customs code links directly to your trade license, and customs authorities verify that declared goods match your licensed business activities. Therefore, ensuring your license covers all product categories you intend to import prevents clearance delays and potential penalties. Additionally, the customs code connects to your Dubai Customs and Dubai Trade portal accounts, enabling electronic declaration submissions and real-time shipment tracking.

Businesses must maintain active customs registration throughout their operations, as the code is required for every import declaration, payment of duties and fees, coordination with freight forwarders, and warehouse operations. Consequently, losing customs registration status halts all import activities until resolution.

Comprehensive Documentation Requirements for UAE Imports

Proper documentation forms the foundation of successful UAE imports from India. Missing or incorrect documents trigger immediate clearance delays, demurrage charges, and potential shipment rejection. Moreover, customs authorities conduct thorough document verification, and discrepancies between documents and physical shipments create serious compliance issues.

Mandatory Import Documents

The commercial invoice serves as the primary document, issued by the Indian exporter and addressed to the UAE importer. It must include detailed goods descriptions using internationally recognized terminology, accurate quantities with proper units of measurement, itemized pricing showing unit prices and total values, complete supplier and consignee information including addresses and contact details, and proper HS code classification for each product line.

Pricing on the commercial invoice must reflect the actual transaction value. Deliberately undervaluing goods to reduce duty payments constitutes customs fraud with severe penalties. Additionally, the invoice should specify the currency used and include any applicable trade terms like FOB, CIF, or DDP that clarify responsibility for costs and risks.

Certificates of Origin and Their CEPA Importance

The Certificate of Origin verifies where products were manufactured, which determines applicable duty rates. For India-UAE trade, the Certificate of Origin under the India-UAE CEPA unlocks preferential tariff treatment, reducing duties to zero on approximately 80% of Indian products.

Indian exporters obtain Certificates of Origin from authorized issuing authorities listed in the CEPA agreement, including chambers of commerce and designated government agencies. The certificate must be issued within specific timeframes relative to shipment dates and contain precise details matching other shipping documents. Furthermore, the certificate declares that goods meet CEPA rules of origin requirements, typically requiring 40% regional value content from India.

Without a proper CEPA Certificate of Origin, your shipment defaults to standard duty rates of 5%, significantly increasing import costs. Therefore, coordinating with your Indian supplier to ensure correct certificate issuance before shipment represents a critical cost-saving measure.

Bills of Lading and Airway Bills

The bill of lading for sea freight or airway bill for air cargo serves as the shipment contract and title document. Importers need the original bill of lading to claim goods from the shipping line, making proper handling essential. The document must contain accurate consignee information matching your customs registration, detailed cargo descriptions consistent with other documents, proper container or package numbers and seals, and clear notation of any special handling requirements.

Additionally, shippers should issue the bill of lading “to order” or directly to the consignee based on your payment and ownership transfer arrangements with the Indian supplier. Clean bills of lading without notations of damage or discrepancies facilitate faster clearance, while claused bills trigger additional inspection requirements.

Packing Lists and Additional Documentation

Packing lists provide detailed cargo breakdowns showing exactly what’s in each container, pallet, or package. This document assists customs inspectors during physical examinations and helps warehouse operators properly handle and store goods. The packing list should detail individual package contents with item counts, gross and net weights for each package, dimensions for customs and logistics planning, and clear marking and numbering matching external package labels.

Depending on product categories, additional documents may be required. Food products need phytosanitary certificates and health certifications, pharmaceuticals require Ministry of Health approvals and registration documents, electronics need ESMA conformity certificates, and restricted items require import permits from relevant UAE authorities.

UAE Customs Duty Structure and Tax Obligations

Understanding UAE customs duties and taxes enables accurate cost forecasting and competitive pricing. The UAE maintains one of the most competitive duty structures globally, which partly explains its position as a major trade hub.

Standard Customs Duty Rates

The standard customs duty rate is 5% of the CIF value—meaning Cost, Insurance, and Freight combined. This calculation method includes the product purchase price paid to the Indian supplier, international shipping costs from India to UAE, and insurance covering the shipment during transit.

For example, if you import goods worth $10,000 with $1,000 in shipping and $200 in insurance, your CIF value is $11,200. The 5% customs duty would be $560. This straightforward calculation applies to most product categories entering the UAE.

Value Added Tax on Imports

Beyond customs duty, the UAE applies 5% Value Added Tax on imports. VAT is calculated on the CIF value plus customs duty, creating a compounding effect. Using the previous example, VAT would be calculated on $11,760 ($11,200 CIF plus $560 duty), resulting in $588 in VAT.

The total tax burden for this shipment would be $1,148 ($560 duty plus $588 VAT), representing approximately 10.2% of the original product value. However, VAT-registered businesses can reclaim input VAT through regular VAT returns, effectively neutralizing this cost for business-to-business transactions.

Special Duty Categories and Exemptions

Certain product categories face different duty structures. Alcohol products attract 50% customs duty rather than the standard 5%, reflecting government policies to regulate alcohol consumption. Tobacco products face even higher rates at 100% customs duty plus 100% excise tax, making tobacco imports significantly more expensive than most goods.

Conversely, several essential product categories enjoy zero percent customs duty. These include livestock, meat, and seafood supporting food security objectives, fresh vegetables, fruits, coffee, tea, grains, and seeds, medicines, vaccines, and healthcare products promoting public health, printed books and educational materials supporting education and culture, and industrial machinery and equipment under certain conditions.

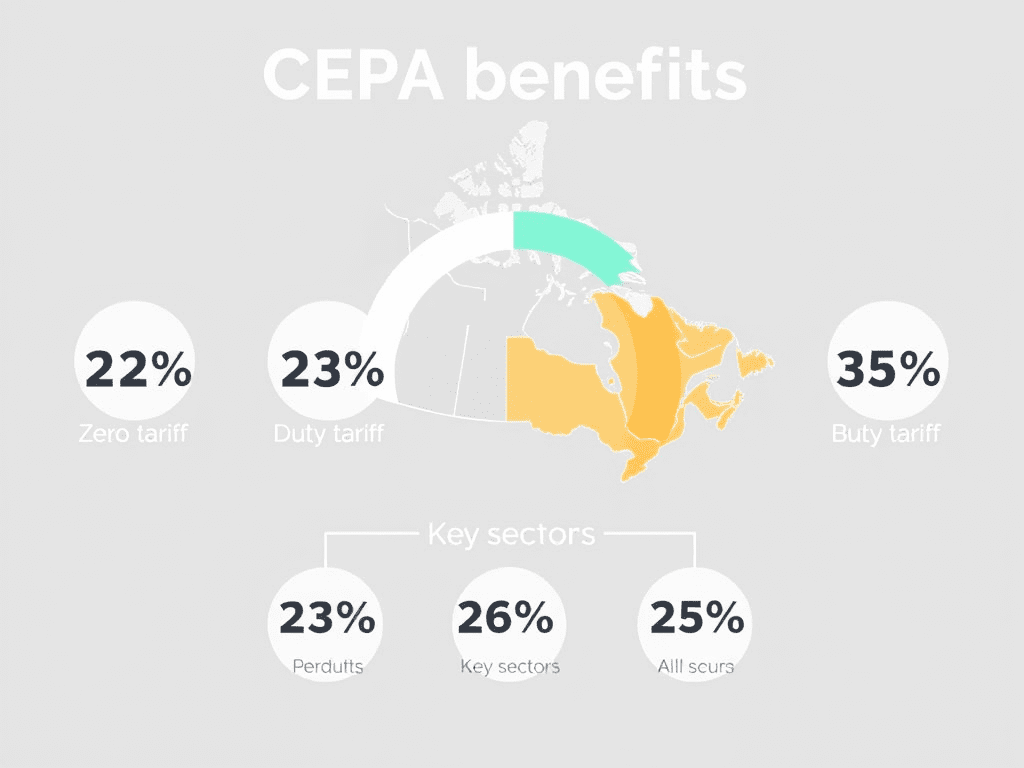

India-UAE CEPA Benefits and Preferential Tariff Access

The India-UAE Comprehensive Economic Partnership Agreement represents one of the most significant developments in bilateral trade, creating exceptional opportunities for businesses importing Indian products to the UAE.

Understanding CEPA Tariff Elimination

Under CEPA, the UAE eliminated duties on 97.4% of its tariff lines, corresponding to 99% of imports from India by value. Approximately 80% of Indian exports to the UAE attract zero duty from day one of CEPA implementation, while another 9% will reach zero duty through phased reductions over ten years.

This tariff elimination transforms the economics of importing Indian goods. Products that previously faced 5% duty now enter duty-free, immediately improving your cost competitiveness. The agreement covers labor-intensive sectors where India excels, including textiles and apparel, leather goods and footwear, gems and jewelry, pharmaceuticals and medical devices, engineering goods and machinery, and food products and agricultural commodities.

CEPA Certificate of Origin Requirements

To claim CEPA benefits, importers must present a valid CEPA Certificate of Origin issued by authorized Indian authorities. The certificate proves goods originated in India and meet the agreement’s rules of origin requirements. Generally, products must contain at least 40% regional value content from India to qualify for preferential treatment.

Indian exporters can obtain CEPA certificates from designated issuing authorities including the Federation of Indian Export Organizations, Export Inspection Council, designated chambers of commerce, and other government-authorized agencies. The certificate must be issued before or shortly after shipment and contain specific declarations and signatures as prescribed in the CEPA text.

Importantly, importers should verify certificate authenticity during customs clearance. UAE Customs may contact Indian issuing authorities to confirm certificates if questions arise. Therefore, working with reputable Indian suppliers who understand CEPA documentation requirements minimizes verification delays.

Strategic Advantages Beyond Tariff Savings

Beyond immediate duty savings, CEPA provides strategic advantages including simplified customs procedures and faster clearance for qualifying goods, enhanced market access across 111 service subsectors, automatic registration for Indian generic medicines within 90 days, protection against anti-dumping actions on Indian products merely transshipped through the UAE, and framework for resolving trade disputes efficiently.

The agreement also facilitates people movement, allowing easier visa processing for business travelers and creating pathways for Indian professionals to work in the UAE. These provisions support companies establishing UAE operations with Indian expertise and strengthening business relationships across borders.

Step-by-Step UAE Import Process from India

Successfully importing from India to the UAE involves systematic execution of multiple sequential steps. Understanding this process helps you plan timelines, coordinate with stakeholders, and avoid common pitfalls that delay shipments.

Pre-Shipment Preparation

Begin by confirming your products comply with UAE import regulations and technical standards. Check if items appear on restricted or prohibited goods lists, and obtain necessary import permits if required. Next, verify your Indian supplier can provide all necessary documentation including commercial invoices, packing lists, CEPA certificates of origin, and any product-specific certifications.

Simultaneously, arrange international shipping with a reliable freight forwarder or shipping line. Decide whether sea freight or air cargo better suits your timeline and budget needs. Sea freight typically takes 15-25 days from major Indian ports to UAE ports but costs significantly less than air cargo, which delivers in 3-7 days at premium pricing.

Additionally, consider whether to use FOB, CIF, or DDP terms with your Indian supplier. FOB terms require you to arrange shipping and insurance from the Indian port, giving you control but requiring more coordination. CIF terms have the Indian supplier arranging international shipping and insurance to the UAE port, simplifying your logistics. DDP terms have the supplier handling everything including UAE customs clearance and delivery to your warehouse, maximizing convenience at higher cost.

Customs Declaration and Clearance Process

Once your shipment arrives at a UAE port or airport, customs clearance begins. If working with a customs broker, they’ll submit your import declaration electronically through the Dubai Trade Portal or equivalent system in other emirates. The declaration includes all shipment details, your customs code, accurate goods descriptions and HS codes, declared CIF values, and references to supporting documents.

UAE Customs reviews the declaration and supporting documents, verifying information accuracy and completeness. Customs officers may request additional documentation or clarification on specific items. They assess applicable duties and taxes based on HS code classification and CEPA eligibility, then calculate total amounts due.

If customs selects your shipment for physical inspection, officers examine goods to verify they match declared descriptions and quantities. Inspections may be comprehensive or sampling-based depending on risk assessment. Products passing inspection move forward to payment and release, while discrepancies trigger additional questions and potential penalties.

Payment of Duties and Final Release

After customs assessment, you must pay all applicable duties, VAT, and fees. Payment options typically include electronic bank transfers, customs bonded accounts for high-volume importers, and credit facilities for established businesses with good compliance records. Payment processing usually occurs within hours for electronic methods.

Once payment confirmation reaches customs, they release the shipment for delivery. You or your broker receives a delivery order allowing you to collect goods from the port or warehouse. Coordinate with your logistics provider to arrange transport to your facility, ensuring proper handling especially for fragile, perishable, or valuable items.

The entire clearance process typically takes 1-3 days for routine shipments with proper documentation. CEPA-eligible goods often clear faster due to simplified procedures for qualifying Indian imports. However, incomplete documentation, incorrect classifications, or selected inspections can extend clearance to 5-10 days or longer.

Product-Specific Import Requirements and Standards

Different product categories face unique regulatory requirements beyond standard customs procedures. Understanding category-specific rules prevents compliance issues and unexpected costs.

Food Products and Agricultural Goods

Food imports require approval from the UAE Ministry of Climate Change and Environment and compliance with Emirates Authority for Standardisation and Metrology food safety standards. Importers must ensure products meet labeling requirements showing ingredients, nutritional information, manufacturing and expiry dates, and Arabic translations of key information.

Meat products need halal certification from recognized Islamic authorities, health certificates from Indian veterinary authorities, and temperature-controlled shipping with documentation proving proper cold chain maintenance. Plant products require phytosanitary certificates issued by Indian agricultural authorities and inspection for pests, diseases, or contamination upon UAE arrival.

Electronics and Electrical Equipment

Electronic goods must comply with ESMA technical regulations and obtain conformity certificates before importation. This includes mobile phones, computers, and consumer electronics, household electrical appliances, power cables and electrical components, and telecommunications equipment.

ESMA certification involves submitting technical documentation, conducting safety testing at approved laboratories, and registering products in ESMA’s database. The certification process typically takes 2-4 weeks, so planning ahead prevents shipment delays. Moreover, electrical products must meet UAE voltage and plug standards, which may differ from Indian specifications.

Pharmaceuticals and Medical Devices

Pharmaceutical imports face stringent regulation by the UAE Ministry of Health and Prevention. Indian pharmaceutical companies benefit from CEPA provisions allowing automatic registration and marketing authorization within 90 days for generic medicines approved in developed countries like the European Union, United Kingdom, Canada, or Australia.

To import pharmaceuticals, you need Ministry of Health import permits issued per shipment, product registration in UAE pharmaceutical databases, compliance with Good Manufacturing Practice standards, and proper labeling in English and Arabic with dosage information and usage instructions. These requirements protect public health while enabling legitimate pharmaceutical trade.

Textiles and Apparel

Textile and apparel imports face relatively straightforward requirements compared to food or pharmaceuticals, yet quality and labeling standards still apply. Products must display care labels with washing instructions, fiber content descriptions, country of origin, and manufacturer information.

Additionally, certain textile products require ESMA conformity assessment, particularly items in contact with skin like children’s clothing and bedding. Indian textile exporters typically understand these requirements well given the sector’s export experience, but verifying compliance prevents customs rejections.

Common Import Challenges and Practical Solutions

Even experienced importers encounter obstacles when importing from India to the UAE. Anticipating common challenges and knowing solutions accelerates problem resolution and maintains supply chain reliability.

Documentation Errors and Discrepancies

Documentation mistakes rank among the most frequent import challenges. Common errors include HS code misclassifications leading to incorrect duty calculations, invoice and packing list inconsistencies causing customs questions, missing or expired certificates delaying clearance, and spelling errors in company names or addresses creating verification problems.

To minimize documentation errors, create a comprehensive document checklist for every shipment, review all documents carefully before shipment departs India, establish clear communication protocols with Indian suppliers regarding documentation expectations, and work with experienced freight forwarders who understand UAE requirements. Additionally, maintain templates for frequently imported products ensuring consistent, accurate documentation.

Customs Valuation Disputes

Customs authorities may question declared values if they seem inconsistent with typical market prices. Valuation disputes arise when invoice prices appear significantly lower than comparable products, causing customs to suspect undervaluation for duty evasion. Such situations trigger detailed examinations and potential duty adjustments.

Prevent valuation disputes by ensuring invoices reflect actual transaction values, maintaining consistent pricing across shipments for similar products, keeping supporting documentation like purchase orders and payment records, and being prepared to explain genuine price variations based on order quantities, payment terms, or market conditions. Transparency with customs authorities and willingness to provide supporting evidence usually resolves valuation questions quickly.

Delayed Shipment Clearance

Clearance delays frustrate importers and create additional costs through demurrage charges for extended container storage and spoilage risks for perishable goods. Delays typically result from incomplete documentation requiring additional paperwork, physical inspections selected randomly or based on risk profiling, technical regulation compliance verification, and payment processing issues.

Mitigate delay risks by submitting complete, accurate documentation from the outset, choosing experienced customs brokers familiar with your product categories, maintaining adequate working capital for prompt duty payment, and building buffer time into supply chain planning. Additionally, establishing a track record of compliant imports improves your risk profile, reducing inspection frequency over time.

Free Zone vs. Mainland Import Considerations

Businesses operating in UAE free zones enjoy unique advantages but face specific limitations. Free zone companies can import goods duty-free for manufacturing, re-export, or free zone distribution without paying UAE customs duties or VAT until goods enter mainland UAE.

However, when free zone companies sell products into mainland UAE, goods must go through customs clearance and duty payment like any import. Therefore, the choice between free zone and mainland establishment depends on your business model. Companies primarily serving international markets benefit from free zone operations, while businesses focused on UAE mainland customers may find mainland establishment simpler.

Cost Analysis and Budgeting for UAE Imports

Accurate cost forecasting ensures profitable import operations and prevents budget overruns that erode margins. Understanding all cost components enables competitive pricing while maintaining healthy profit margins.

Comprehensive Import Cost Components

Total landed costs for UAE imports from India include product purchase price from Indian supplier, international shipping freight charges, marine or air cargo insurance, customs duty at 5% of CIF value (or zero for CEPA-eligible goods), VAT at 5% of CIF value plus duty, customs brokerage fees for professional clearance services, port handling and storage fees, inland transportation to your facility, and bank charges for international payments and letters of credit.

For CEPA-eligible products, eliminating the 5% customs duty immediately reduces costs by approximately 5% of CIF value. This savings significantly improves competitiveness, particularly for price-sensitive products where small cost differences influence buying decisions.

Sample Cost Calculation Scenarios

Consider importing textiles from India worth $50,000 FOB (Free on Board). International shipping costs $5,000 and insurance costs $500, creating a CIF value of $55,500. Under standard duty rates, you’d pay $2,775 in customs duty (5% of $55,500) and $2,913.75 in VAT (5% of $58,275, which is CIF plus duty). Total taxes equal $5,688.75.

However, with CEPA benefits, customs duty drops to zero. You’d only pay VAT on the CIF value: $2,775 (5% of $55,500). Your tax savings equal $2,913.75—over 52% reduction in import taxes compared to non-CEPA imports. This substantial savings can either improve your margins or enable more competitive customer pricing.

Partnering with NexaCrest International for Seamless UAE Imports

Importing from India to the UAE involves multiple complexities that can overwhelm businesses, especially those new to international trade. From navigating documentation requirements and understanding CEPA benefits to ensuring product compliance and managing logistics, success requires expertise across numerous disciplines.

NexaCrest International specializes in simplifying UAE import operations for international businesses. Our comprehensive services cover every aspect of the import process, allowing you to focus on growing your business while we handle operational complexity.

How NexaCrest Streamlines Your UAE Import Operations

Our team manages complete import documentation preparation, ensuring all certificates, invoices, and permits meet UAE requirements. We coordinate directly with Indian manufacturers to secure proper CEPA certificates of origin, maximizing your tariff savings. Additionally, our established relationships with UAE customs authorities facilitate faster clearance through proven compliant track records.

We handle customs clearance entirely, submitting declarations, responding to customs queries, coordinating inspections when selected, and managing duty and VAT payments. Our logistics network arranges international shipping at competitive rates, manages freight forwarding and cargo insurance, and coordinates final delivery to your UAE facility.

Furthermore, NexaCrest provides ongoing regulatory guidance to keep you informed about changing import requirements, helps classify products correctly to avoid costly misclassifications, and offers strategic sourcing advice to optimize your supply chain costs and reliability.

Why International Buyers Choose NexaCrest

Our clients value our transparent, itemized pricing with no hidden fees, dedicated account managers providing single-point contact, proven track record serving 25+ countries with 88% on-time delivery, and comprehensive market knowledge spanning UAE regulations and Indian manufacturing capabilities.

Whether you’re making your first UAE import from India or looking to optimize existing operations, NexaCrest International provides the expertise and support needed for consistent success. Our team understands that your reputation depends on reliable, compliant imports delivered on time and within budget. We take that responsibility seriously, treating every shipment with the care and attention it deserves.

Ready to simplify your UAE import operations from India? NexaCrest International provides end-to-end support from supplier verification to customs clearance, ensuring your shipments arrive on time and fully compliant. Our team specializes in maximizing CEPA benefits, managing documentation, and navigating UAE regulations so you can focus on growing your business. Contact NexaCrest International today for a free consultation on your UAE import requirements. Visit nexacrestinternational.com or call +91-7676463030 to discuss how we can streamline your import operations and reduce costs through strategic sourcing and professional customs management.